Delaying Medicare Enrollment

There are many reasons why someone would delay enrolling into Medicare, but that can have big impacts on accessing benefits later in life. This presentation is designed to briefly cover some of the reasons for delaying enrollment, but focuses heavily on how to enroll when the time comes.

Why Delay Medicare?

• Still working and have group coverage. This is for individuals that are covered under employer or union group coverage based on their or their spouse’s current employment

• Currently contributing to a Health Savings Account. These individuals will also have a HDHP plan through their employer or union and are actively working, but there are implications on enrolling into Medicare Part A and B which we’ll discuss later.

• Do not qualify for premium-free Part A. The monthly cost for Part A, if you have to pay a premium, ranges from $471-$259 per month for 2021.

• Utilize VA for all health services. Many of these individuals delay enrolling in Part B and are shocked to learn of the late enrollment penalty when they go to sign up in the future.

• Have insurance from the Health Insurance Marketplace. If you have a marketplace plan and then qualify for Medicare, you can keep the marketplace plan but are no longer eligible to receive any premium tax credits, so some choose to delay their Medicare to keep the plan. Unfortunately, marketplace plans are not creditable for delaying coverage and those individuals could pay a penalty in the future.

How To: Delay Part A

In order to delay Part A, each beneficiary needs to understand if they are already receiving, or will be getting, their benefits from Social Security or the Railroad Retirement Board (RRB). If you are receiving those benefits, there is no way to delay their Part A coverage. If you are not yet receiving those benefits then you can delay their Part A coverage by simply not signing up.

How To Delay Part B

There are numerous ways to delay Part B coverage, but depending on their SSI/RRB status will change what needs to be done as they approach age 65.

Will be getting SSI/RRB benefits at least 4 months before they turn 65:

• Follow the instructions that come with their Medicare card to decline Part B coverage and send it back, or:

• Contact Social Security at 800-772-1213 to delay coverage.

Will not be getting SSI/RRB benefits at least 4 months before they turn 65:

• Simply do not sign up for Part B benefits.

Signing Up For Benefits

After delaying Medicare A and/or B, there are different ways to sign up for benefits depending on the beneficiary’s specific situation.

Part A

If you are eligible for premium-free Part A, you can enroll at any time after you’re first eligible for Medicare with no late enrollment penalty – all you have to do is contact Social Security to enroll.

However, your Part A will go into effect retroactively 6 months from when you first signed up, but no earlier than the first month you were eligible for Medicare. For individuals that are contributing to a HSA this is very important, as you will need to stop contributing to their account 6 months prior to signing up.

If you are not eligible for premium-free Part A:

• There is a 10% penalty for every 12-month period they were eligible but did not have Part A

• The penalty will be paid for twice the number of years you went without cover (i.e. if they went 2 years without coverage, they would pay the Part A penalty for 4 years)

• You must sign up for Part B (or be actively enrolled) in order to buy Part A, and will be subject to signing up during a valid timeframe (SEP/GEP)

Part B

• Apply online with Social Security at https://ssa.gov/benefits/medicare

• Visit your local Social Security office or call them at 800-772-1213

• If you worked for a railroad, call the RRB at 877-772-5772 to sign up

• If you already have Part A and want to sign up for Part B, you will need to complete the CMS-40B form (and CMS-L564 form if they were working)

Part B Sign Up Periods

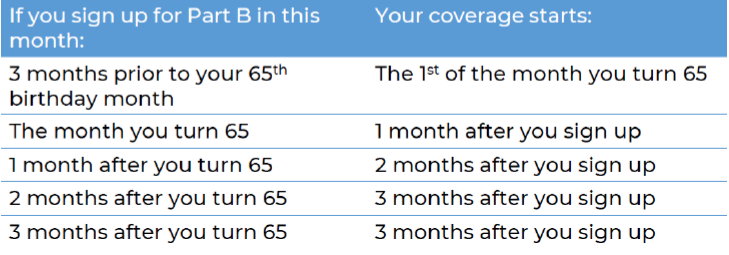

Initial Enrollment Period – 3 months before, the month of, and 3 months after their 65th birthday month. Benefits start date is determined by when you enrolled during their IEP:

Special Enrollment Period – this only applies to individuals who were covered under employer or union coverage based on their or their spouse’s current employment. You can sign up any time they are covered by the plan, or up to 8 months after their coverage or employment ends, whichever happens first.

General Enrollment Period – this happens between January 1st to March 31st each year, with coverage starting the following July 1st.

Part B Late Enrollment Penalty

If you delayed Part B, you may have to pay a Late Enrollment Penalty (LEP) when you sign up.

• 10% for every 12-month period since you were eligible

• Penalty is waived if you qualified for the Part B SEP and signed up during that timeframe

• Retiree plans, individual health, ACA and Veterans Benefits are not creditable coverage for delaying part B

Recap

There’s a great resource that’s published by CMS called CMS Fact Sheet: Deciding Whether to Enroll in Medicare Part A and Part B When You Turn 65 (CMS Publication No. 11962). This document has a great “choose-your-own-story” flow to it that will help you quickly identify your specific situation and how they should approach the idea of delaying Medicare benefits.

Resources:

https://www.cms.gov/Outreach-and-Education/Find-Your-Provider-Type/Employers-and-Unions/FS3-Enroll-in-Part-A-and-B.pdf

Do you understand all of your options? Consultations are always free!

info@lifetimecarepartners.com

info@lifetimecarepartners.com 561-507-0660

561-507-0660