Medicaid VS Medicare

This presentation is a high-level overview of how Medicare and Medicaid work together to provide healthcare coverage and financial support for individuals with limited income and resources.

As separate topics, Medicare and Medicaid can be quite in-depth, but having a basic understanding of how the programs work together can help a Medicare beneficiary find solutions to their healthcare and financial needs.

Medicare vs. Medicaid

It’s important to understand the differences between Medicare and Medicaid, as they can oftentimes be confused with one another, especially when educating beneficiaries.

Medicare is a federal health insurance program for individuals age 65 and older, those under age 65 with certain health conditions, and those of all ages with ALS or end-stage renal disease.

Medicaid is a joint state and federal program designed to provide financial assistance for individuals with limited income and resources. It’s important to understand that Medicaid is not true insurance coverage, as it requires enrollment in a qualified healthcare plan like Medicare or a managed care program.

Medicare Savings Program

The portion of the state Medicaid program that covers Medicare beneficiaries is called the Medicare Savings Program. While Medicaid programs are ran by the state, each state is required to have a Medicare Savings Program in place. There are 4 levels of coverage:

Qualified Medicare Beneficiary (QMB)

Specified Low-Income Medicare Beneficiary (SLMB)

Qualifying Individual (QI)

Qualified Disabled and Working Individual (QDWI)

Individuals with both Medicare and Medicare are called “dual-eligible”.

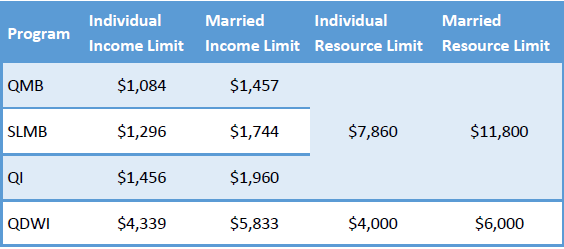

Qualifications

States use income and/or resources to determine the benefit level.

Countable resources include:

• Money in a checking or savings account

• Stocks

• Bonds

Countable resources do not include:

• A home

• One care

• Burial plot

• Up to $1,500 for burial expenses if you have put that money aside

• Furniture

• Other house and personal items

Benefits

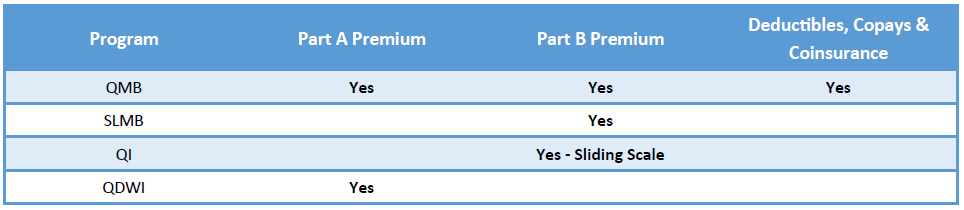

The Medicare Savings Program provides financial assistance with Medicare Part A and Part B premiums, deductibles, copays and coinsurances. QMB, or full benefit dual eligible, recipients receive the highest level of support as all Medicare premiums and cost sharing are paid for by the program.

SLMB and QI will only have coverage for the Part B premium, and the QDWI program was specifically designed to help disabled and working individuals pay for their Part A premiums (if they haven’t worked their 40 quarters to receive premium-free Part A).

Using Medicare & Medicaid

QMB, or full benefit dual eligible, individuals have the most coverage from the program, but also have the most restrictions on provider access. Individuals must utilize providers that accept both Medicare and the state Medicaid program.

If someone goes to a provider that accepts Medicare but doesn’t participate with the state’s program they are subject to pay for the cost-sharing of original Medicare Parts A & B. SLMB and QI individuals can see any doctor that accepts Medicare as the program isn’t coordinating the payment of any benefits.

It’s important to understand that QMB or full benefit individuals cannot receive bills for any services received from providers that participate in both programs. If they receive a bill they should notify the provider that they are part of the state Medicaid program and they should reach out to state for payment.

Medicaid is the “payer of last resort”, which means that it will only pay for claims after all other coverages have had a chance to pay their portion. So, Medicare pays claims first, and Medicaid would pay 2nd.

Extra Help

Extra Help, or low income subsidy, is the Social Security program designed to help individuals with limited income and resources (the same individuals that qualify for the Medicare Savings program) with financial assistance towards the cost of their Part D program. Individuals that qualify for QMB, SLMB or QI automatically qualify for extra help and do not need to apply separately.

It’s important to remember that the Medicare Savings Program works with Medicare Part A and Part B to provide financial assistance for individuals with limited income and resources, and Extra Help helps with the Part D prescription drug coverage.

Signing Up

There are primarily two methods to sign up for the Medicare Savings Programs:

1. Fill out the application for Extra Help through the Social Security Administration at www.ssa.gov/prescriptionhelp. There’s a question during the application process that states “Information about Medicare Savings Programs:

You may be able to get help from your State with your Medicare costs under the Medicare Savings programs. To start your application process for the Medicare Savings Programs, Social Security will send information from this form to your State unless you tell us not to. If you want to get help from the Medicare Savings Programs, do not complete this question. Just sign and date the application and your State will contact you.”, or;

2. Call your state Medicaid Program to see if you qualify

Special Needs Plans

Special Needs Plans (SNP) are Medicare Advantage plans that tailor their benefits, provider choices, and drug formularies to best meet the needs of the specific groups they serve. One type of SNP is specifically designed for Medicare and Medicaid beneficiaries, called a Dual Eligible Special Needs Plan (DSNP).

DSNPs are designed to coordinate benefits between Medicare, the state Medicaid program, providers and the beneficiary. They’re designed to help low income individuals access the care that’s necessary to maintain health conditions and improve quality of life.

DSNPs are sold by private insurance companies, can be either HMO or PPO plans and always in-clude drug coverage. Their availability will vary by state and county, and you can view a list of plans through Medicare.gov’s Plan Finder.

HMO DSNP plans require beneficiaries to stay within a specific network for coverage, while PPO DSNP members can go outside of the plan’s network but must see providers that accept Medicaid in order for their benefits to be covered.

Full benefit dual eligible, QMB or SLMB+ (state specific) beneficiaries can enroll in a DSNP.

DSNP Enrollment

Dual-eligible individuals can enroll in a DSNP any time between January 1st and September 30th using a Special Election Period. There is only one enrollment allowed per quarter during that time:

• January through March

• April through June

• July through September

Dual-eligibles can utilize the Annual Enrollment Period at the end of the year to change their plans during the last quarter of the year, with benefits starts the following January 1st.

DSNP Extra Benefits

In addition to Part A, Part B and Part D benefits, DSNPs may include coverage for various ancillary items, including but not limited to:

• Care Coordination

• Dental

• Fitness

• Hearing

• Meals

• Over-the-counter items (or personal care health items)

• Personal emergency response systems

• Virtual Visits

• Vision

• And more

Additional benefits can and will vary by plan and plan year.

info@lifetimecarepartners.com

info@lifetimecarepartners.com 561-507-0660

561-507-0660