Understanding High Deductible Medigap Plans

A great way to fill the gaps of Original Medicare and save on premium dollars is to purchase a high deductible Medigap plan. This presentation is designed to cover the basics of a Medicare Supplement (Medigap) plan and how a high deductible options works.

Medigap 101

Medicare Supplement Insurance (Medigap) policies have been around since 1967, and are one of the most popular options to cover the gaps in Original Medicare parts A and B. They’re sold by private insurance companies, cover some benefits that Original Medicare doesn’t cover (like emergency foreign travel), and can be used with all providers and facilities that accept Medicare across the country.

A Medigap plan pays second to Medicare. This means that all claims must be filed with Medicare first, who will calculate their approved amount and pay their portion, then the Medigap policy will jump in and pick up the remaining costs based on which plan the beneficiary is enrolled in. If Medicare doesn’t approve of and pay for the service, then the Medigap policy won’t pay either (except emergency foreign travel coverage, when applicable).

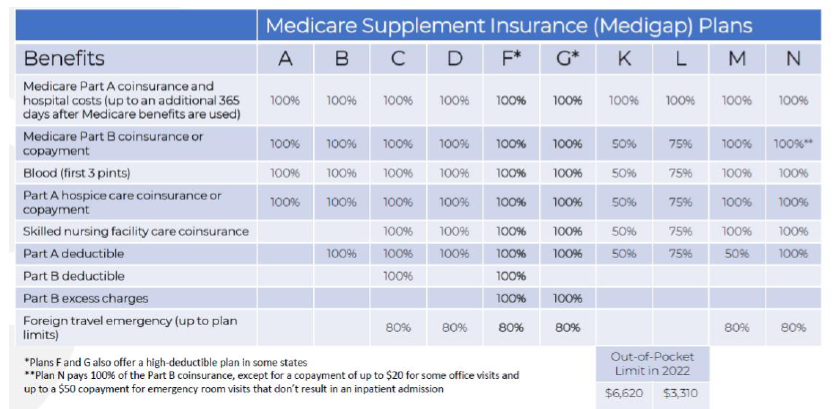

Medigap plans are standardized in all states except Massachusetts, Minnesota and Wisconsin.

There are 10 options to choose from, all denoted by their own plan letter: A, B, C, D, F, G, K, L, M, N. Each Medigap policy under the same plan letter must offer the same benefits, regardless of which carrier sold it. However, prices can vary wildly for the same plan letter across multiple carriers who offer it.

Read More ==> The Insider’s Guide On Medicare Supplemental Plans

High Deductible Medigap Plans

There are two high deductible plans available, F and G. These programs offer the same benefits as the standardized plans, but only pay benefits after the beneficiary satisfies an annual policy deductible. The deductible can change each year, and the deductible for 2022 is $2,490.

There can be some confusion around the deductible because it can lead beneficiaries to believe that they have to pay all of their healthcare costs before they receive any coverage. Luckily, during the deductible phase, Medicare still pays the claims as they always have. Once Medicare processes and pays the claims, anything that’s left over in the form of deductibles, coinsurances or copays through Original Medicare must be paid by the beneficiary until the annual deductible is satisfied.

While High Deductible Plan G does not offer coverage for the Part B Deductible, the amount a beneficiary pays towards the Part B Deductible will count towards the High Deductible Plan G deductible. High Deductible Plan F is only available to individuals that qualify for Medicare prior to January 1st, 2020.

How the Deductible Works

Example: John spends 3 days in the hospital as an inpatient, then he’s transferred to a skilled nursing facility where he receives some rehabilitative care for 15 days before being discharged to head home. John’s costs under Original Medicare would include:

• Hospital Stay for 3 days: Part A Deductible $1,556 in 2022

• Skilled Nursing Stay for 15 days: $0 for days 1-21

John’s total out of pocket for the hospital and skilled nursing stay would be $1,556 in 2022, which would be applied towards his plan’s deductible of $2,490. He would need to spend another $934 in deductibles, coinsurances or copays to satisfy the annual deductible so the plan’s benefits can kick in.

Example: Alena received a cataract surgery at the beginning of the year in an outpatient facility. The Medicare-approved amount for her surgery was $2,825. Alena’s costs under Original Medicare would include:

• Part B Deductible: $233 in 2022

• 20% of remaining cost: $524

Alena’s total out of pocket for the outpatient procedure would be $757 in 2022, which would be applied towards her plan’s deductible of $2,490. She would need to spend another $1733 in deductibles, coinsurances or copays to satisfy the annual deductible so the plan’s benefits can kick in.

Why a High Deductible Plan?

Medigap plans F and G generally have the highest premiums amongst all the plan options (A-N). Purchasing a High Deductible plan can reduce monthly plan premiums by up to 73% (based on rates for a 65 year old female, non tobacco, in zip code 33912 as of June 30, 2021). The idea behind adding a deductible is to reduce monthly premium by assuming more risk

Got Questions? I’m here to help!

info@lifetimecarepartners.com

info@lifetimecarepartners.com 561-507-0660

561-507-0660