The Insiders Guide On Medicare Supplemental Plans

This presentation is designed to educate beneficiaries on Medicare Supplement plans, including what they cover, available plans, special state rules and underwriting.

Medicare Supplement Plans

Medicare Supplement plans, sometimes called Medigap plans, are sold by private insurance companies and are designed to fill the gaps in Original Medicare parts A and B. Clients can use their plan to see any doctor/hospital that participates in the Federal Medicare program (except for Medicare Select policies). There are 10 standardized plans except in MA, MN and WI where they have different plan options.

What do they cover?

Medigap plans cover the gaps in Medicare Parts A and B.

Part A:

- Inpatient deductible

- Inpatient copays for days 61+

- Skilled Nursing Facility coinsurance

- Hospice copay for inpatient respite care

- First 3 pints of blood

Part B:

- Annual deductible

- 20% coinsurance

- Part B excess charges. For doctors that participate in Medicare but do not accept Medicare’s assignment (i.e. they don’t agree to Medicare’s payment as payment in full), they are allowed to charge up to 15% over and above Medicare’s approved amount.

Medigap plans can also cover travel to a foreign country, additional home health care days and preventive services not covered by Medicare.

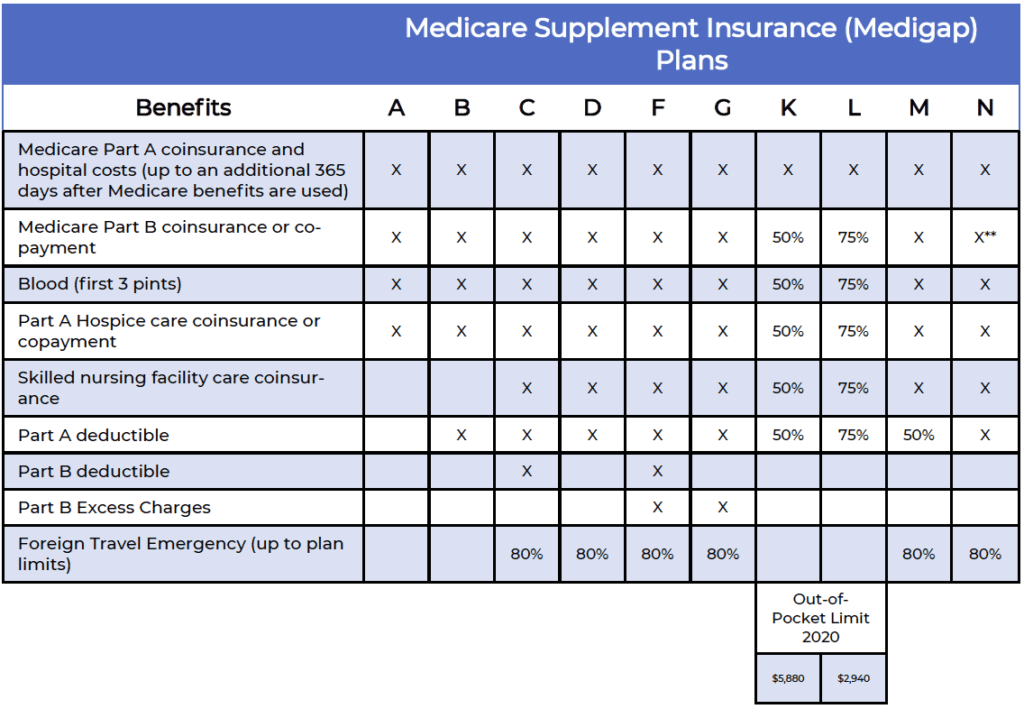

National Options

In all states except MA, MN and WI, there are 10 modernized plans that carriers can make

available to beneficiaries: A, B, C, D, F, G, K, L, M, N.

The most commonly sold plans are F and G, as they provide two of the most comprehensive benefit packages available. The biggest difference between the plans are the coverage for the Part B deductible, with Plan G leaving out that coverage.

As of January 1st, 2020, individuals who qualify for Medicare or turn age 65 after that date cannot purchase a plan that covers the Part B deductible, so Plan G has become the go-to option for many newly-eligible beneficiaries.

You can also find high-deductible options of plans F and G, in which Medicare will pay first, then the client is responsible for 100% of out-of-pocket costs until they reach a yearly deductible, then the supplement plan will pick up 100% of the costs for the remainder of the year.

These plans have a premium that is considerably less than traditional F and G options, but availability will vary by state.

Plan N has become a popular option since it was released in 2010, providing a comprehensive package of benefits for an affordable premium. For some Part B services, policyholders may pay up to a $20 for a doctor office visit and up to a $50 copay for emergency room visits (which is waived if they are admitted to the hospital).

Plans K & L offer a cost-sharing option to beneficiaries, as the plans cover either 50% or 75%, respectively, of the gaps in Medicare up to a specific out-of-pocket limit, then 100% thereafter.

In most states, plan K is the lowest premium option available to consumers and may be a popular option for individuals who consider themselves healthy and are looking for the protection and freedom of a Medigap plan without the high price of a Plan F or Plan G.

Select Medicare Supplement plans are available in some parts of the country, and mimic the benefits of any of the modernized plans (A thru N), but utilize a specific network of hospitals and, in some cases, doctors that policyholders must use for any planned procedures.

These plans are only offered in specific zip codes and if a client moves out of the plan’s service area, they would have a guaranteed right to purchase a plan from any carrier.

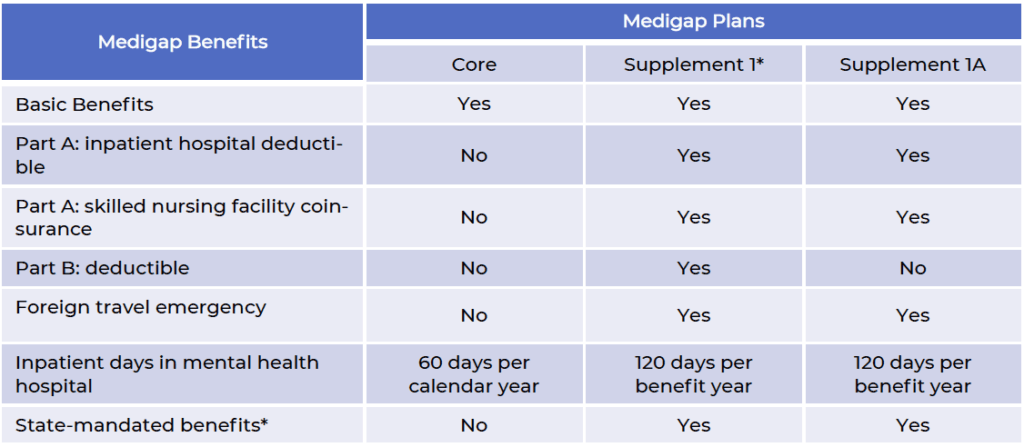

Massachusetts

Massachusetts offers three policy options, Core, Supplement/Plan 1 and Supplement/Plan 1A.

Basic benefits include:

- Inpatient hospital coinsurance up to 365 additional days after Medicare coverage ends

- Part B coinsurance

- First 3 pints of blood

- Part A hospital coinsurance or copay

State-mandated benefits include yearly Pap test and mammograms. Supplement/Plan 1 is only available to beneficiaries who turned age 65 or were active on Medicare prior to January 1, 2020.

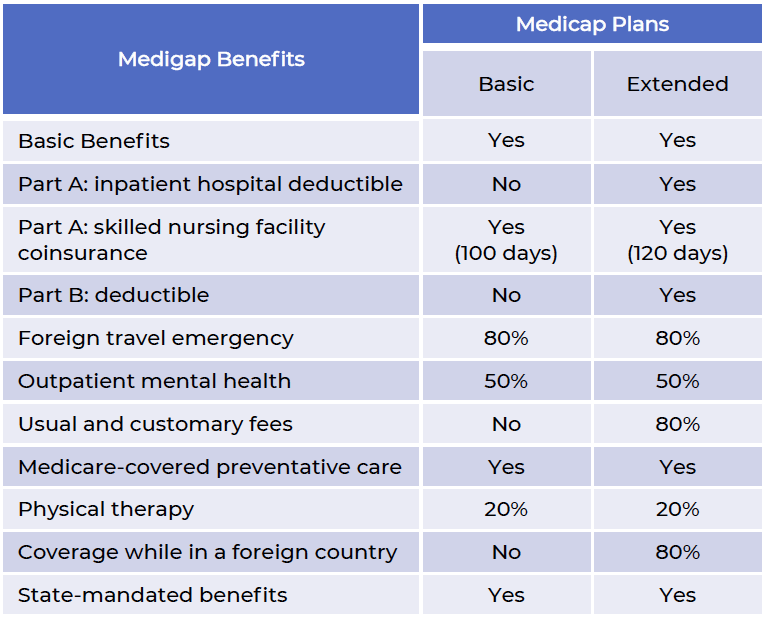

Minnesota

Minnesota offers two plans, a Basic plan w/rider and an Extended Basic plan.

Basic benefits include:

- Part A coinsurance

- Part B coinsurance

- First 3 pints of blood

- Part A hospice and respite care

- Part A and B home health services and supplies.

State mandated benefits in-clude:

- Diabetic equipment and supplies

- Routine cancer screening

- Reconstructive surgery

- Immunizations

- Refer to outline of coverage for more mandated benefits

The Extended basic plan cannot be sold to beneficiaries who turned 65 or become eligible for Medicare after January 1st, 2020, so they can purchase the Basic plan and add any available riders, including:

- Part A Deductible

- Part B Deductible (for those on Medicare/age 65 prior to 1/1/2020)

- Part B Excess Charges

- Preventive Care

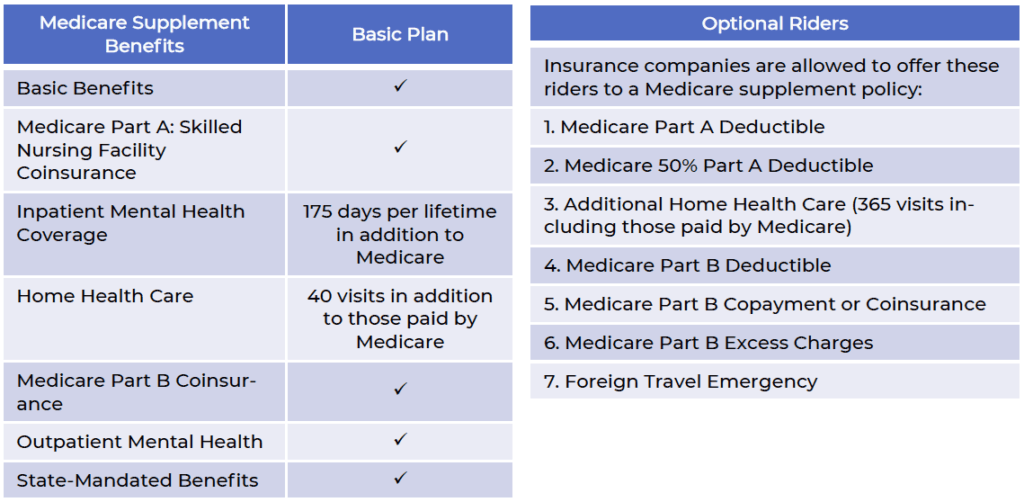

Wisconsin

Wisconsin offers a basic plan with optional plan riders.

Basic benefits include:

- Inpatient Part A coinsurance

- Part B coinsurance

- First 3 pints of blood.

The Part B deductible rider only available to those age 65 or on Medicare prior to January 1st, 2020.

The Part B Copayment or Coinsurance rider provides premium savings in exchange for policy- holder paying up to a $20 copay for doctor office visits and up to $50 for emergency room visits (waived if admitted), and cannot be combined with the Part B deductible riders.

Select plans are also available, meaning that the client would need to utilize in-network hospitals for any and all planned hospital visits.

Wisconsin mandated benefits include 30 days of skilled care in a skilled nursing facility, inpatient & outpatient expenses for kidney dialysis, transplantation, or donor-related services of kidney dis- ease, diabetes treatment, chiropractic care, colorectal cancer screening, and coverage of certain health care costs in cancer clinical trials.

How much do they cost?

Premiums for Medigap policies can vary based on age, gender, zip code, health conditions and tobacco use. As a general rule of thumb, plans with lower benefits will have lower premiums, and plans with higher benefits mean higher premiums. It’s best for beneficiaries to get as many quotes as possible so they can understand all their options.

Premiums structures will vary across states, and will either be Attained Age, Issue Age, or

Community Rated.

Attained Age

States: AK, AL, CO, DC, DE, HI, IA, IL, IN, KS, KY, LA, MD, MI, MS, MT, NC, ND, NE, NJ, NM, NV, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, WI, WV, WY

Premiums are based on the current age of a client, and will increase each year as the policyholder ages. Rates can also be adjusted for gender, zip code, health conditions and tobacco use. The premiums can also change when the companies adjust rates for all policyholders, usually once pear year.

Issue Age

States: AZ, FL, GA, ID, MO, NH

Premiums are based on the age of the client when they first purchase the plan. Rates can also be adjusted for gender, zip codes and tobacco use. The premiums can change when the companies adjust rates for all policyholders, usually once per year. Premiums will be their lowest at age 65.

Community Rated

States: AR, CT, ME, MN, NY, VT, WA

Premiums are the same regardless of age or gender, but can vary based on zip code, health conditions and tobacco use. Premiums only change when the companies adjust rates for all policyholders, usually once per year.

When can I buy one?

Open Enrollment Period

The Open Enrollment Period starts when a client turns age 65 or starts their Part B and lasts for 6 months. They can choose any plan from any carrier during this time, and can even change plans from one to the next during the 6-month period. They cannot be denied due to health history but may be subject to tobacco rates (varies by state/carrier).

Guaranteed Issue

These are certain situations where a client has a guaranteed right to buy a policy and their acceptance is guaranteed. These include losing group coverage, moving out of a Medicare advantage plan’s service area, your Medicare Advantage plan is leaving your county, you join a Medicare Advantage plan for the first time after leaving a Medicare Supplement plan and decide to change back within 12 months, loss of Medicaid (varies by state), etc. Please refer to the Choosing a Medigap Policy guide for full details.

Underwriting

Medicare Beneficiaries can apply for a Medicare Supplement plan at any time, as long as they can pass underwriting.

- Series of yes/no health questions

- Company may ask for prescription information

- May require a telephone interview

IMPORTANT: Beneficiaries should not cancel their current coverage until they receive approval from the Medicare Supplement carrier.

Under Age 65 Plans

Many states offer plans to individuals who qualify for Medicare due to disability or specified dis-

ease under age 65. Available plans may vary and certain time restrictions may apply.

Guaranteed Renewable

All Medicare Supplement plans are guaranteed renewable, which means that insurance carriers cannot cancel a policy for any reason as long as premiums are being paid. This means that beneficiaries cannot be canceled because they move from one state to another or have high claims.

Prescription Coverage

Medicare Supplement plans do not cover outpatient prescription drugs, so beneficiaries must purchase a stand-alone Part D plan if they desire that coverage.

Got Questions? I’m here to help!

info@lifetimecarepartners.com

info@lifetimecarepartners.com 561-507-0660

561-507-0660