What Is Medicare Part D Extra Help

The Medicare Part D program started January 1st, 2006, and now covers over 48 million beneficiaries. Part D was the first time the national healthcare program provided prescription drug benefits and helped make medications more affordable. Even with the new savings, many beneficiaries have trouble with the cost of their prescriptions. Part of the Medicare Modernization Act of 2003, the law responsible for Part D, included the Low Income Subsidy program to provide financial assistance to beneficiaries with limited income and resources. This presentation describes the LIS/Extra Help program to give beneficiaries an idea of the benefits and the parameters in which they would qualify.

What is Extra Help?

The Extra Help program is a national program, administered by the Social Security Administration, for Medicare beneficiaries to provide financial assistance in paying the costs of their Part D coverage, including monthly premiums, annual deductibles, and copayments.

Qualifications

In order to qualify, beneficiaries must:

• Medicare Part A and/or Part B

• Have limited income and resources

• Reside in one of the 50 states or the District of Columbia

Individuals that qualify for Extra Help must have Medicare prescription drug coverage in order to utilize the benefits, either through a stand-alone Part D plan (PDP) or a Medicare Advantage Part D Plan (MAPD). NOTE: If a beneficiary qualifies for Extra Help but does not sign up for a Part D or MAPD plan, SSA will auto-enroll them into an available PDP plan.

Resource Limits

SSA utilizes a resources test to determine who qualifies for the benefit. In 2022, resources must be limited to $14,790 for an individual or $29,520 for a married couple living together. An additional $1,500 for an individual and $3,000 for a married couple living together is added to these numbers for money saved for burial expenses.

Resources include the value of the things the beneficiary owns, including real estate (other than their primary residence), bank accounts, stocks & mutual funds, bonds (including U.S. Savings Bonds), individual retirement accounts (IRAs), and cash at home or anywhere else.

What is not counted as a resource are:

• Their primary residence

• Their personal possessions

• Their vehicle(s)

• Resources they couldn’t easily convert to cash, such as jewelry or home furnishings

• Property they need for self-support, such as rental property or land they use to grow produce for home consumption

• Non-business property essential to their self-support

• Life insurance policies

• Burial expenses (up to $1,500 for an individual or $3,000 for a married couple living together)

• Interest earned on money they plan to use for burial expenses

There are certain other moneys they hold that’s not counted as a resource for nine months from the time of enrollment, such as:

• Retroactive Social Security or Supplemental Security Income (SSI) payments

• Housing assistance

• Tax advances and refunds related to earned income tax credits and child tax credits

• Restitution as a crime victim

• Relocation assistance from a state or local government

Income Limits

Beneficiaries with an annual income of less than $19,320 as an individual and $26,130 as a married couple living together may qualify for Extra Help. Income should be based on what they file for taxes each year, but does not include:

• Supplemental Nutrition Assistance Program (food stamps)

• Housing assistance

• Home energy assistance

• Medical treatment and drugs

• Disaster assistance

• Earned income tax credit payments

• Assistance from others to pay your household expenses, including any benefits they may receive through their Medicare Advantage plan like a monthly OTC allowance, food card, etc.

• Restitution payments

• Scholarships and education grants

Extra Help Benefits

According to the Social Security Administration, Extra Help is estimated to be worth about $5,000 per year per eligible beneficiary. Extra Help provides financial assistance for paying many aspects of Part D coverage, including monthly premiums, late enrollment penalties, annual deductibles (if any), prescription copayments and coinsurances, and the coverage gap

Premium Subsidy

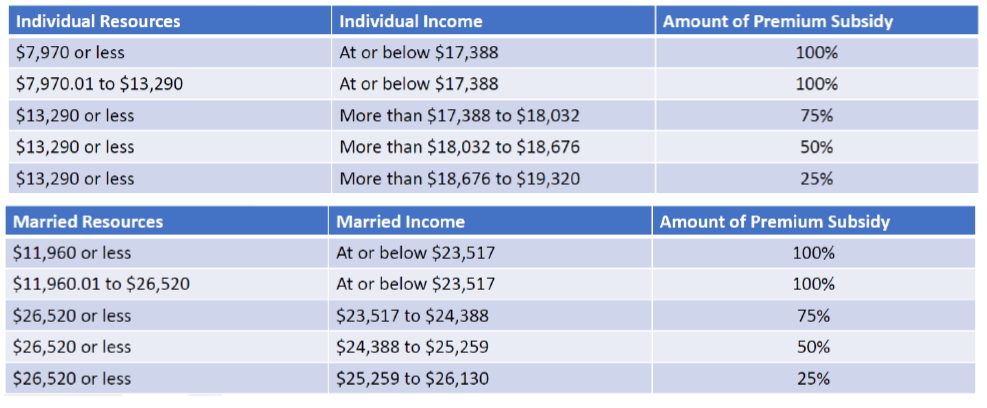

Based on the beneficiary’s income and resources, Extra Help can provide a subsidy to help re-duce or eliminate the plan premium:

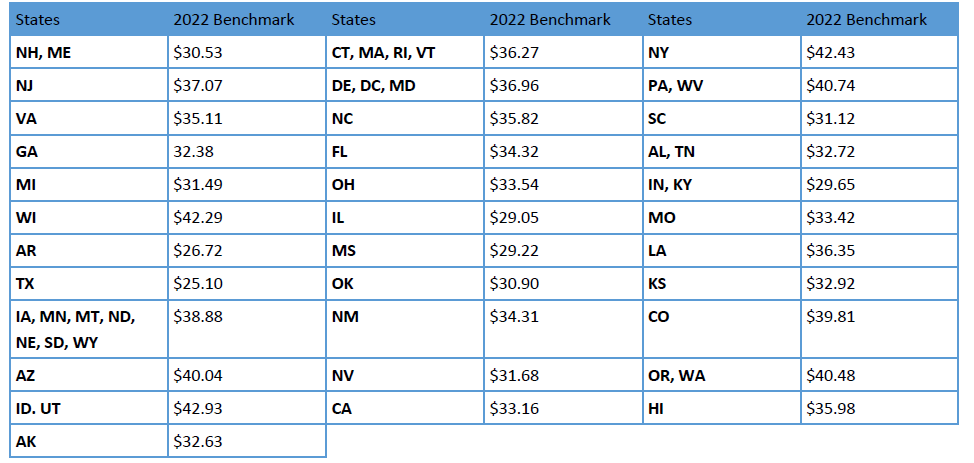

The premium subsidy is based on the “benchmark premium” from CMS. Each Part D region has a specific benchmark premium that it will pay based on the beneficiary’s premium subsidy. Here are the 2022 Part D Premium Benchmarks by region:

For example:

• A 100% premium subsidy in New York will pay up to $42.43 per month in 2022. If the plan costs $50 per month, the beneficiary would pay the difference, a total of $7.57.

NOTE: for MAPD plans that carry a premium, a portion of that premium is for the Part D benefits. As long as the Part D portion of the MAPD premium is not over the benchmark, and the beneficiary qualifies for 100% premium subsidy, then the Part D portion will be covered in full. For example, a MAPD plan has a $25 monthly premium, but the Part D portion is only $10. With a 100% premium subsidy, the client would be left to pay the remaining $15 per month for the health portion of the MAPD premium.

Late Enrollment Penalties

Beneficiaries that qualify for any level of Extra Help, and owe a late enrollment penalty, will have the penalty waived for as long as remain eligible for Extra Help. The penalty is waived regardless of their level of premium subsidy.

Deductible Help

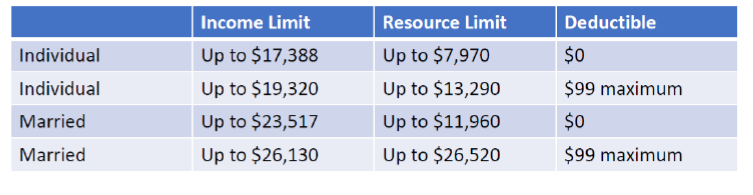

Based on income and resource levels, they may qualify for 100% deductible coverage, or have it reduced to a maximum of $99

Prescription Cost Help

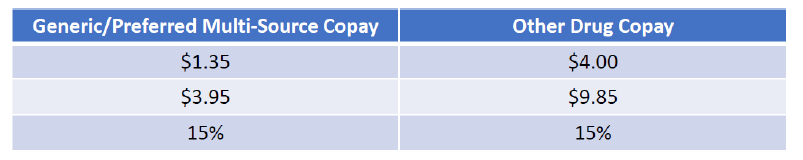

Outside of premiums and deductibles, the main purpose of the Extra Help program is to reduce the cost of medications for the eligible beneficiaries. Depending on their level of income and resources, and their Medicaid status, they could pay as little as $0 for covered medications, or:

Their copays would remain the same through the coverage gap, if applicable.

Signing Up for Extra Help

There are three main methods to sign up, either through their local Social Security office, by calling SSA at 800-772-1213, or by going online to https://www.ssa.gov/benefits/medicare/prescriptionhelp.html (fastest method). The process can take up to 30 days for approval, and beneficiaries should be prepared to provide financial information including all sources of income, checking & savings, stocks, bonds, mutual funds, etc.

Got Questions? Contact me – I’m here to help!

info@lifetimecarepartners.com

info@lifetimecarepartners.com 561-507-0660

561-507-0660