Income-Related Monthly Adjustment Amount (IRMAA)

There are situations where Medicare beneficiaries may have to pay more for their Medicare Part B and Part D coverage due to their income. This is called an Income-Related Monthly Adjustment Amount (IRMAA) and was enacted as a way to help the Medicare program stay solvent as the Baby Boomer generation became eligible for benefits.

The Part B IRMAA was a result of the passing of the Medicare Modernization Act of 2003, the same act that expanded the funding for the Medicare Advantage programs as well as created the Medicare Part D program. The Part D IRMAA was a result of the passing of the Affordable Care Act of 2010.

Eligible Income

The income used to determine a beneficiary’s IRMAA is defined by Medicare as “adjusted gross income plus any tax-exempt interest”, also known as the Modified Adjusted Gross Income (MAGI). Examples of eligible income include:

• Wages

• Social Security Benefits

• Capital Gains

• Dividends & Pensions

• Rental Income

• Tax-deferred distributions from 401(k)s or IRAs

It’s important to note that the MAGI used to determine IRMAA is always based on tax returns from two calendar years ago. For instance, 2021 IRMAAs are based on filed tax returns from the 2019 tax year.

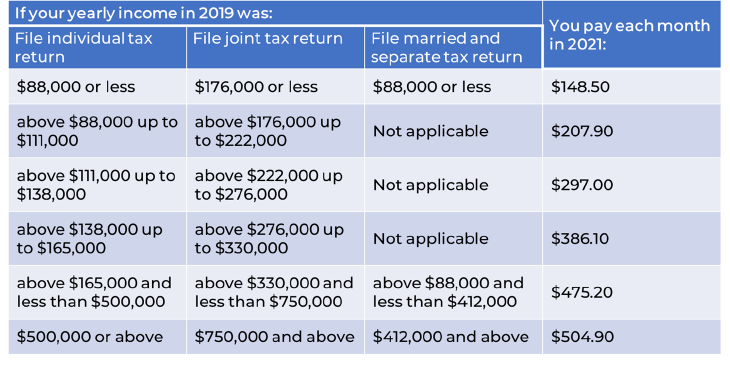

Part B IRMAA

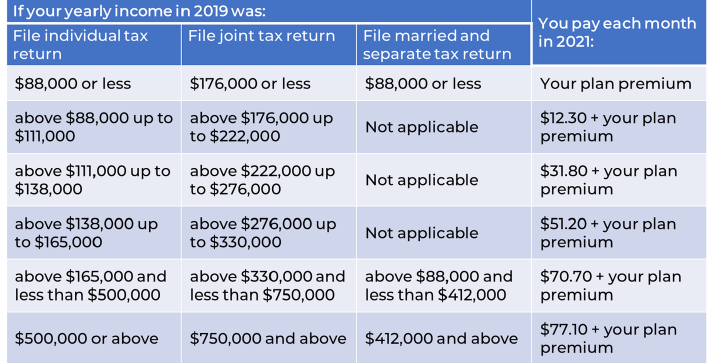

Part D IRMAA

Do You Owe IRMAA?

If beneficiaries are required to pay a Part B or Part D IRMAA, they will be notified by Social Security of the increase in premium(s). IRMAA can be paid one of two ways:

• Monthly deduction from a beneficiary’s Social Security check (this is the best way to determine if a high-income beneficiary is already paying IRMAA), or

• They’ll receive a bill from Medicare or the Railroad Retirement Board to pay their premiums direct

Beneficiaries will never be asked by their Medicare Advantage or Part D carrier for IRMAA payments.

How to Appeal

If a beneficiary feels like they should not owe a Part B or Part D IRMAA, they can submit an appeal to Social Security. This could be due to the fact that the increase in their MAGI was due to a once in a lifetime inheritance where their income was only higher for a brief period and now their increased Part B or Part D premium may not be affordable. In any case, beneficiaries can file an appeal by:

• Completing form SSA-44 “Medicare Income-Related Monthly Adjustment Amount—Life-Changing Event” and submitting it to Social Security, or

• Schedule an interview with their local Social Security office by calling 800-772-1213 (make sure they bring along proof of their current income).

Medicare IRMAA income thresholds and amounts can change on a calendar year basis

Got Questions! I’m here to help.

info@lifetimecarepartners.com

info@lifetimecarepartners.com 561-507-0660

561-507-0660